What Is Settlement?

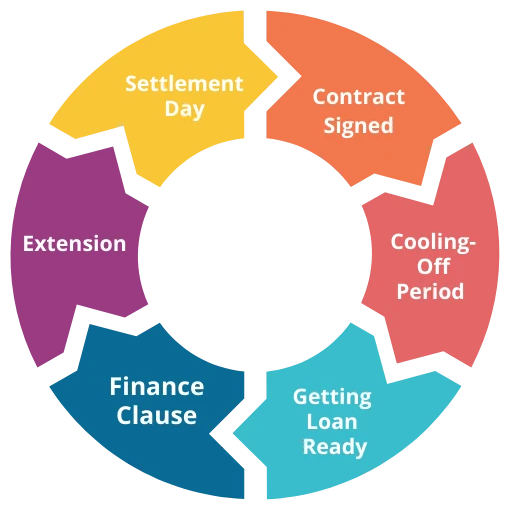

Settlement is the day when you officially become the owner of the Queensland property, and you hand over the money. It’s like the finish line of buying a house.

You sign the contract → get a loan from the bank → lots of paperwork happens → settlement day → you get the keys!

The Three Main Stages

STAGE 1: The Contract Is Signed (Day 1)

- You and the seller sign a Queensland REIQ contract.

- You pay a deposit (usually 10% of the price) to the real estate agent.

- You agree on a settlement date—how long you need to get everything ready (usually 30 days in Qld – this is the standard).

- Important: You have a 5 business day cooling-off period after you receive the signed contract. If you change your mind during this time, you can cancel—but you lose 0.25% of the purchase price.

Your job: Make sure you understand the settlement date and when your loan needs to be approved.

The Five Business Day Cooling-Off Period (QLD)

What it is: After you receive the signed contract, you have 5 business days to change your mind and cancel the sale.

Important details:

- Weekends and public holidays don’t count—only business days (Monday–Friday)

- You must give written notice to cancel

- If you cancel, you lose 0.25% of the purchase price (e.g., $1,875 on a $750,000 property)

- After 5 business days, the cooling-off period ends—you’re locked in!

When this doesn’t apply:

- If you bought at an auction

- If you’re buying a commercial property

- If you’re a company or large investor

Example: You receive the signed contract on a Thursday. Your 5-day cooling-off period is: Friday, Monday, Tuesday, Wednesday, Thursday. It ends at 5:00 PM on Thursday.

STAGE 2: Getting Your Loan Ready (Days 1–30)

This is the busy stage. You need to get the bank to say “yes” to lending you the money.

What happens:

- The bank checks your money – Do you earn enough? Do you have debts? Can you pay the loan back? This is called “assessment.”

- The bank checks the property – Is it worth the price you’re paying? They send someone to look at it and value it. This takes 1–2 weeks.

- You get “conditional approval” – The bank says “yes, we’ll lend you the money, BUT we need a few more things first”:

- Property must be valued ✓

- Insurance arranged ✓

- If using a trust: guarantee arranged ✓

- You give the bank what they asked for – Send documents, insurance quotes, trust paperwork, etc. This usually takes 1–2 weeks.

- The bank says “yes” for real – This is called “unconditional approval.” Now you’re locked in!

Total time for this stage: Usually 2–4 weeks.

Why this matters to you: You MUST get your loan approved before the finance clause expires. If the bank says “no,” you can cancel the deal and get your deposit back. If you don’t get approval by the deadline, the contract becomes unconditional—you HAVE to buy the house.

The Finance Clause (Queensland)

In your REIQ contract, there’s a section called the “finance clause” (usually clause 3). This is very important for you.

What it says: “You have to buy the house UNLESS your bank says no to the loan by the finance date.”

How long you have in Queensland:

- Standard: 14–21 days from the contract date

- If paying cash: no finance clause needed

- If using a trust: ask for 21 days (you need the extra time for the bank’s trust checks)

Important numbers:

- 14 days = risky, only do this if you have pre-approval

- 21 days = safer, recommended

- 30 days = total settlement date from contract (Queensland standard)

If your bank says no:

- You can cancel the sale

- You get your deposit back

- The seller keeps the property

If you don’t get approval by the deadline:

- The contract becomes unconditional

- You HAVE to buy the house, even if the bank says no

- You lose your deposit and could face extra costs

- This is a real risk – don’t agree to a short finance clause unless you have pre-approval

Example: Contract signed Day 1, finance clause is 21 days. By Day 21 at 5:00 PM, the bank must give you unconditional approval. If they haven’t, you need to ask for an extension (see below).

Settlement Date Extension (Clause 6.2, Queensland REIQ Contract)

This is new in Queensland contracts and it’s your safety net.

What it is: If you need more time to settle, you can ask for up to 5 extra business days.

How it works:

- You must ask before 4:00 PM on the original property settlement date

- You must ask in writing

- You don’t need the seller’s permission for the first 5 days

- After 5 days, the seller must agree to any more extensions in the transfer process.

Example: Settlement was meant to be Day 30. By 4:00 PM on Day 30, you notice the bank isn’t ready. You send a written notice asking for a 5-day extension. New property settlement date is now Day 35.

Important: This extension only applies to settlement date, not the finance clause. If your finance clause expires before settlement, that’s a different problem.

STAGE 3: Final Paperwork & Settlement Day

Once the bank says “yes” (unconditional approval), things move fast.

What happens after unconditional approval:

- The bank prepares your loan documents – These are contracts that say how much you’re borrowing and what you owe. Takes 2–3 days.

- If you’re buying through a trust: A lawyer gives the person who is guaranteeing the loan legal advice. They have to understand they might have to pay if you can’t. This takes 2–3 days.

- The settlement agent gets everything ready – They collect all the paperwork, check it, and organize it for settlement day. Takes 2–3 days. In Queensland, this happens through PEXA.

- Settlement day arrives (usually Day 30, or later if you asked for an extension):

- You and the seller’s lawyer arrange a final time

- Your bank sends money to the settlement agent

- The settlement agent pays the seller during the conveyancing process.

- The settlement agent gives you the title (proof you own the house)

- The keys get handed over to you

- All of this happens online now through PEXA (Property Exchange Australia)—it takes about 1 hour

After settlement day:

- Your name gets added to the Queensland property register (Titles Queensland) as part of the transfer process.

- The money comes out of your bank account

- Settlement funds usually appear in the seller’s account the same day

- The house is yours!

What Is PEXA? (Queensland)

PEXA is Queensland’s electronic settlement process system.

What it does:

- All parties (buyer, seller, banks, lawyers) work in a secure online workspace

- Documents are signed electronically

- Money transfers electronically

- Title is registered electronically with Titles Queensland

- No need to meet in person

Benefits:

- Fast (30 minutes to 1 hour)

- Secure

- Real-time updates

- Less risk of mistakes

Cost: Usually about $137 (included in your conveyancing fees)

How Long Does It All Take?

| Stage | Time | What Happens |

|---|---|---|

| Sign contract & pay deposit | Day 1 | Receive contract; cooling-off period starts |

| Cooling-off period | Days 1–5 (business days) | Can cancel if you change your mind (costs 0.25%) |

| Bank assessment & property valued | 2–4 weeks | Bank checks your money & the house |

| Loan approval (conditional) | 1–2 weeks | Bank says “yes, but we need more” |

| You send extra paperwork | 1–2 weeks | Send documents, insurance, trust papers |

| Loan approval (unconditional) | 1–3 days | Bank says “yes, we’re ready!” |

| Final paperwork & settlement prep | 5–7 days | Lawyers prepare all documents; PEXA workspace ready |

| Settlement day | 1 hour | Money transfers via PEXA, you get the keys! |

Total: Usually 30 days from signing the contract to settlement day (Queensland standard).

What You Need to Do: Buyer’s Checklist

After you sign the contract, do these things as quickly as possible. Remember: cooling-off period is only 5 business days!

DAYS 1–5: Cooling-Off Period (Act Quickly if You Change Your Mind)

- Receive the signed contract

- Read it carefully

- If you change your mind, notify in writing BEFORE 5:00 PM on Day 5 to ensure proper disclosure.

- If you stay, move to the next steps

WEEK 1: Right After Cooling-Off Period Ends

- Arrange a home inspection (final walkthrough to check nothing is broken)

- Start the loan application with the bank or mortgage broker

- Organize home and contents insurance quote

- Tell the bank about the property you’re buying

- If cooling-off period ends on a weekend/public holiday, it rolls over to next business day

WEEK 2–3: Getting the Loan Approved

- Get the property valued (bank will arrange this)

- Send the bank:

- Recent payslips (last 2)

- Tax returns (last 2 years)

- Bank statements (last 2–3 months)

- Any debts you have (car loans, credit cards, etc.)

- Proof of savings for the deposit

- If buying through a trust: Give the bank your trust documents

- Keep in touch with your mortgage broker or bank—ask for updates every few days

WEEK 3: After Conditional Approval

- Answer any extra questions from the bank

- Finalize your home insurance

- If using a trust: Your lawyer will arrange for the guarantor to get legal advice (this is required by law)

- Keep checking with your mortgage broker or bank for unconditional approval

WEEK 3–4: After Unconditional Approval

- The bank will send you loan documents to sign – do this quickly

- If using a trust: The guarantor meets with their lawyer (can be done over video call)

- The settlement agent will contact you with the settlement date and time

- PEXA workspace will be set up – check your access

WEEK 4: Before Settlement

- Do a final walkthrough of the property (usually 2–3 days before settlement) to check:

- Nothing is broken or damaged

- Everything promised is still there

- All agreed repairs are done

- Smoke alarms are installed (Queensland law—must be compliant by settlement)

- Confirm settlement time with your lawyer

- Make sure you have money for settlement costs (fees, stamp duty, etc.)

SETTLEMENT DAY (Day 30, or later if extended)

- Sign any last-minute documents via PEXA

- Settlement agent handles the money transfer

- You get the keys!

Special: If You’re Buying Through a Trust in Queensland

What is a trust? A legal structure that owns the property instead of your name appearing on the title. People use trusts for tax, privacy, or investment reasons.

Why does it take longer?

The bank needs to check:

- Is the trust properly set up?

- Is the person who guarantees the loan (usually you or your family) ready to take that responsibility?

- Does the person understand they might have to pay if the trust can’t?

Extra time needed for the conveyancing process: Add 1–2 weeks to your timeline.

Extra steps you need to do:

- Give the bank a certified copy of your trust deed (they will check it before approving)

- The person guaranteeing the loan meets with a lawyer for independent legal advice (this is the law)

- The lawyer writes a certificate saying the person understands the risks

- Send this certificate to the bank

- Some banks charge an extra “trust vetting fee” of about $300

Timeline for trust purchases:

- Days 1–5: Cooling-off period

- Days 5–10: Bank checks your trust documents

- Days 10–14: Guarantor gets legal advice from a lawyer

- Days 14–17: Lawyer’s certificate is sent to the bank

- Days 17–21: Bank approves the loan

- Days 21–45: Settlement prep and PEXA workspace

Important: Make sure your guarantor is available for a lawyer meeting within the first 2 weeks. If they live overseas, arrange it early!

Timeline for Buying Through a Trust: 21-Day vs. 30-Day Settlement

If you want a 21-day settlement (fast):

You need to:

- Already have pre-approval from the bank ✓

- Have the guarantor ready to meet a lawyer immediately ✓

- Use a bank that accepts electronic (digital) signatures ✓

- Everything happens at the same time, not one after another ✓

This is risky if things go wrong – only do this if you’re confident and have pre-approval.

If you want a 30-day settlement (safer, Queensland standard):

- You have more time for the bank to check everything

- If something goes wrong, you have time to fix it

- The guarantor can meet a lawyer whenever they’re available

- This is the standard in Queensland and what most people choose

- You can use the 5-day extension clause (Clause 6.2) if you need it

The Settlement Day Timeline (30 Minutes Before to 1 Hour After)

11:30 AM – Last Checks (via PEXA)

- Your lawyer confirms everything is ready

- Seller’s lawyer confirms everything is ready

- Your bank confirms money is ready to transfer

- All parties log into PEXA workspace

12:00 PM – Settlement Happens (PEXA System)

- Everyone logs into the PEXA workspace

- Your bank sends the money electronically

- Seller’s lawyer receives the money electronically

- The title documents transfer to you electronically

- All documents are automatically lodged with Titles Queensland

- Your name is registered as the new owner

12:30 PM – It’s Done

- Settlement is complete

- Your lawyer notifies the real estate agent

- Real estate agent arranges key handover

- You can collect the keys!

Same Day or Next Business Day

- Seller’s bank account receives the money

- Your name appears on the Queensland property register

- You can move in whenever you want!

Important: Time Is of the Essence (But With Grace)

Old rule (harsh): If settlement didn’t happen on the exact day, the contract could be cancelled.

New rule in Queensland (Clause 6.2, from 2022): You can ask for a 5-day extension if settlement is delayed. This gives you and the seller protection if the bank is slow.

How to use it: Contact your lawyer BEFORE 4:00 PM on the settlement date. They’ll send a written notice to the seller’s lawyer asking for the extension.

Key Dates to Remember

| When? | Who Does What? |

|---|---|

| Day 1 | Sign contract; pay deposit (10%); receive signed copy; cooling-off period starts |

| Days 1–5 | Cooling-off period—you can cancel (lose 0.25% of price) |

| Days 2–10 | Bank starts assessment; arrange valuation |

| Days 10–14 | Property valued; bank reviews documents |

| Days 14–21 | Bank gives conditional approval; send extra documents |

| Days 21–25 | Bank gives unconditional approval |

| Days 25–28 | Settlement agent prepares final documents; PEXA workspace ready |

| Days 26–28 | Final walkthrough of property (Pre-Settlement Inspection) |

| Days 28–30 | Final fund confirmation from bank |

| Day 30 | SETTLEMENT DAY – Settlement happens via PEXA; you get the keys! |

The Bottom Line: Queensland Timeline

Buying a house is a process that takes time.

From contract to settlement usually takes 30 days (this is the Queensland standard).

Breakdown:

- Days 1–5: Cooling-off period (you can still cancel)

- Days 5–21: Finance approval (bank checks everything)

- Days 21–45: Final paperwork and settlement

If you’re buying through a trust, add 1–2 weeks because the bank needs extra checks and the guarantor needs legal advice.

Your job is to:

- Understand the cooling-off period (5 business days—act fast if you change your mind)

- Send documents to the bank quickly

- Stay in touch with your mortgage broker

- Do your final walkthrough before settlement

- Show up on settlement day ready to sign via PEXA

Joerg is Founder of Buyers Scout and a Brisbane-based buyers agent with over 5 years of professional experience helping owner-occupiers, investors, and developers acquire property. His background in property development and 30 years of analytical experience in IT and cyber security provide a unique foundation for rigorous property analysis and due diligence. Based in Brisbane for over 10 years, he specialises in helping local, interstate, and migrant buyers navigate Brisbane’s property market.

FAQs: Headline

How long does settlement take in Queensland?

Settlement typically takes 30 days from when you sign the contract, though this can range from 21 days to 60 days depending on what’s negotiated. The standard timeline is:

- Days 1–5: Cooling-off period

- Days 5–21: Finance approval from the bank

- Days 21–30: Final paperwork and PEXA settlement preparation

- Day 30: Settlement day (money transfers, you get the keys)

If you’re buying through a trust, add 1–2 extra weeks (35–40 days total) because the bank needs additional time to check trust documents and arrange guarantor legal advice.

What is the cooling-off period and how does it work?

In Queensland, you have 5 business days after receiving the signed contract to change your mind and cancel the purchase. This is a legal protection unique to Queensland buyers.

Key details:

- The period starts the day you receive the fully signed contract

- Weekends and public holidays don’t count—only business days (Monday–Friday)

- You must cancel in writing before 5:00 PM on the 5th business day

- If you cancel, you lose 0.25% of the purchase price (e.g., $1,875 on a $750,000 property)

No reason needed – you can just change your mind

When it doesn’t apply:

- Auction purchases (no cooling-off period at auctions)

- Commercial properties

- If you waive it in writing (not recommended)

What is the finance clause and why is it important?

The finance clause (Clause 3 in the REIQ contract) protects you if your bank says “no” to your loan. It’s one of the most important parts of your contract.

What it says: “The contract is conditional on the buyer getting loan approval for the Finance Amount from the Financier by the Finance Date.”

Important points:

- You must fill in all three details: Finance Amount, Financier name, and Finance Date (usually 14–21 days)

- Standard timeline: 14–21 days from contract date

- For trusts: Ask for 21 days minimum

- You must “take all reasonable steps” to get approval – you can’t just not try

What happens:

- Bank says YES before the deadline: Contract becomes unconditional, you must proceed

- Bank says NO before the deadline: You can cancel and get your deposit back

- No answer by the deadline: Contract becomes unconditional automatically—you’re stuck even if the bank later says no

Critical: This is different from the cooling-off period. The finance clause protects you if the bank refuses; cooling-off protects you if you change your mind.

When do I get the keys after settlement?

You get the keys on settlement day, usually within 30 minutes to 2 hours after settlement completes via PEXA (typically between 12:00 PM and 3:00 PM).

How it works:

Settlement happens electronically via PEXA (usually noon–2:00 PM)

Money transfers from your bank to the seller

Title documents transfer to you

Your lawyer or conveyancer notifies the real estate agent that settlement is complete

You collect the keys from the real estate agent

Important: Settlement can be delayed on the day—don’t book removalists until settlement is confirmed

Some settlements don’t complete until late afternoon (5:00–6:00 PM)

If settlement is delayed by several days, you won’t get keys until it actually happens

Always confirm with your lawyer before scheduling movers or ending your lease

Best practice: Book your moving day for 1–2 days after the scheduled settlement date to avoid being stuck if there’s a delay.

Can I extend the settlement date if I need more time?

Yes! Queensland’s REIQ contract includes Clause 6.2, which allows you to extend settlement by up to 5 business days automatically—you don’t need the seller’s permission.

How it works:

- You must notify the seller in writing before 4:00 PM on the original settlement date

- You can extend for up to 5 business days

- This is automatic—the seller must accept it

- After 5 days, you need the seller’s permission for further extensions

Example: Settlement is scheduled for Day 30. At 2:00 PM on Day 30, your bank says they need 3 more days. Your lawyer sends a written notice to the seller’s lawyer asking for a 5-day extension. New settlement date is Day 35.

When to use it:

- Your bank is running late with documents

- PEXA workspace isn’t ready

- There’s a last-minute issue with the title

- The guarantor’s legal advice is delayed

Important: This clause only extends the settlement date, not the finance clause. If your finance clause is 21 days and you don’t have approval by Day 21, you can’t use Clause 6.2 to save it—that’s a different issue.

Summary:

Buying property in Queensland typically takes 30 days from contract to keys. After signing and paying your deposit, you have a 5 business day cooling-off period (costs 0.25% to cancel). Your finance clause (14–21 days) protects you if the bank refuses your loan.

The bank assesses your application for 2–3 weeks, then prepares documents. Settlement happens electronically via PEXA on Day 30 – taking about 1 hour. You collect keys that afternoon.

Trust purchases: Add 1–2 weeks (35–40 days total).

Costs: Budget 4–10% extra for stamp duty, conveyancing ($885–$2,000), and adjustments.

Share This Blog On: